madison county real property tax services

The cost is 1200 for each request for plat certification. Madison County Service Center 1918 North Memorial Parkway Huntsville AL 35801.

Generally modifications to the tax maps are only done if there is a certified survey available.

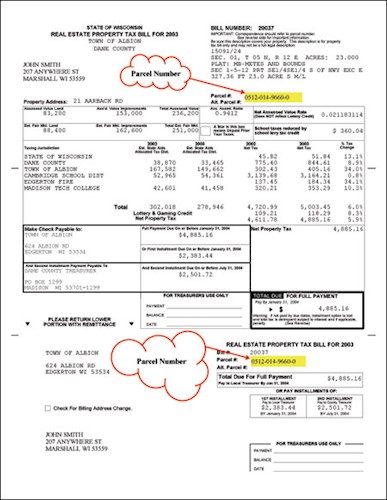

. Landis or Madison County Treasurer. Statement Parcel Legal Contains. Find Your Covenants.

View Real and Personal Property Millage Rates. City of Madison Treasury. Early in 2022 we launched a new planning effort called Plan MC to update and refine Madison Countys Comprehensive Plan to guide growth and development for the next decade.

Image Mate Online is Madison Countys commitment to provide the public with easy access to real property information. 911 Addressing Mapping and Tax Mapping. Madison County Schools K-12.

Huntsville AR 72740 Email. When searching choose only one of the. City County Building 210 Martin Luther King Jr.

2017 - 2018. View Automobile and Manufactured Housing Millage Rates. 2017 - 2018.

HOURS OF OPERATION. Madison County with the cooperation of SDG provides access to RPS data tax maps and photographic images of properties. Office Hours are 800AM to 400PM Monday through Friday.

Find Your Covenants. Madison County Chamber of Commerce. They will review your property and explain any circumstances that they are aware of.

830 AM - 500 PM 256 532-3300 256 489-8000. 31 May 31. Drivers License 830-400 Reg Office 8-430.

View Board Minutes. Ion Business Concepts Payments. Real Property Tax Receipt Search.

Madison County has an existing Comprehensive Plan that was developed and adopted in 2010. Please note there is a 25 convenience fee PLUS a 30 transaction fee for all credit or debit transactions. Tax Rates and Tax Levy.

It is suggested to bring in the original plat for certification. You can even setup automatic payments to pay your Spring and Fall installments or you can setup monthly payments to make it easier to budget for your property taxes. Property Tax Payments Table.

Madison County Extension Office. If you are paying by escrow. Tax maps and images are rendered in many different formats.

You may also pay by credit card and e-check by calling 800272-9829 or online using jurisdiction code 3614. HOURS OF OPERATION. To search for tax information you may search by the 15 to 18 digit parcel number last name of property owner or site address.

The Madison County Tax Collectors office offers the convenience of paying your property taxes online. Tax payments cannot be made at the local banks. State DHS Social Services.

Madison County is one of the fastest growing counties in Mississippi yet we have sought to remain a small friendly community full of rich history and looking forward to a bright future. Make checks payable to. Call the Madison County Office of Real Property Tax Services and ask to speak with the Tax Mapper or if they are not available the Director.

The 2030 Comprehensive Plan will establish goals policies and programs intended. Pay Property Tax. Tax payments can be made by mailing them to the Treasurers Office or at the window in our office in the administration building in Virginia City.

Return the bottom portion of your property tax bill with your payment. Lisa Tuten Tax Collector. Questions About Payment of Taxes Call the Madison County Treasurer at 740-852-1936 or 1-877-454-3309 within Madison County We accept Cash Credit Cards Money Orders or Checks.

This browser is unsupported. Traffic - Ordinance Ticket. Madison County Treasurers Office.

The certification states that there are NO UNPAID taxes on the property that is being subdivided. When paying with an escrow check endorse the back of the check. For questions on displayed information contact Madison County Treasurer 402 454-3311 x133.

Simply click on the link below and follow the steps to begin your payment process. Return to the Tax Collectors Section. Office of Real Estate Services.

Balance Due 514035 Other. To properly view the tax maps and images contained within this. Click NEXT to Pay Your Personal Property and Real Estate Taxes in Madison County Arkansas.

Pay Property Tax. 830 AM - 500 PM. It is the duty of the Treasurer to collect all taxes due to the County and to receive and account for every other form of revenue which comes to the County including license fees permit fees State income taxes and fees.

Please make checks payable and send to. Home Departments Boards Committees Commissioners. The County Clerk will check the current and delinquent tax files to verify tax payments.

Property Tax Reform Report. Thank you for your cooperation. If all taxes are paid in full the County Clerk will sign and affix the County Seal to the plat.

Planning Community Economic Development. Visa Mastercard Discover and E-checks are accepted. Real Property Tax Receipt Search.

Click here for information on LB1107 Nebraska Income Tax Credit for School District Taxes Paid Nebraska Property Tax Incentive Act Credit Tax Year. Madison County North Carolina. You can now pay your property taxes online by electronic check with your checking or savings account online with no additional fees.

For the best experience it recommended that you use the latest versions of Chrome Edge or Safari. Madison County Property Tax Inquiry. Madison County Library System.

Madison County Courthouse 100 North Side Square Huntsville AL 35801. Pinckney Street Room 102.

Florida Property Tax H R Block

Wilmington Trinity Vicinity Home 902 Madison Wilmington New Castle De Kw Realty Denc476262 Real Estate Sales Real Estate Realty

Liberty Middle School Middle School Liberty Madison

Madison County Va Real Estate Homes For Sale Realtor Com

Tax Maps Real Property Tax Services Latin America Map Tax Services Political Map

Tax Maps Real Property Tax Services Latin America Map Tax Services Political Map

Pay Property Tax Online Dane County Treasurer Office

Property Taxes Madison County Sheriff S Office Kentucky

23812 23 Hwy Huntsville Arkansas 72740 Arkansas Real Estate Metal Storage Buildings Iconic Landmarks

56256 Madison Mn Real Estate Homes For Sale Re Max

About Valerie Miles Madison County Al

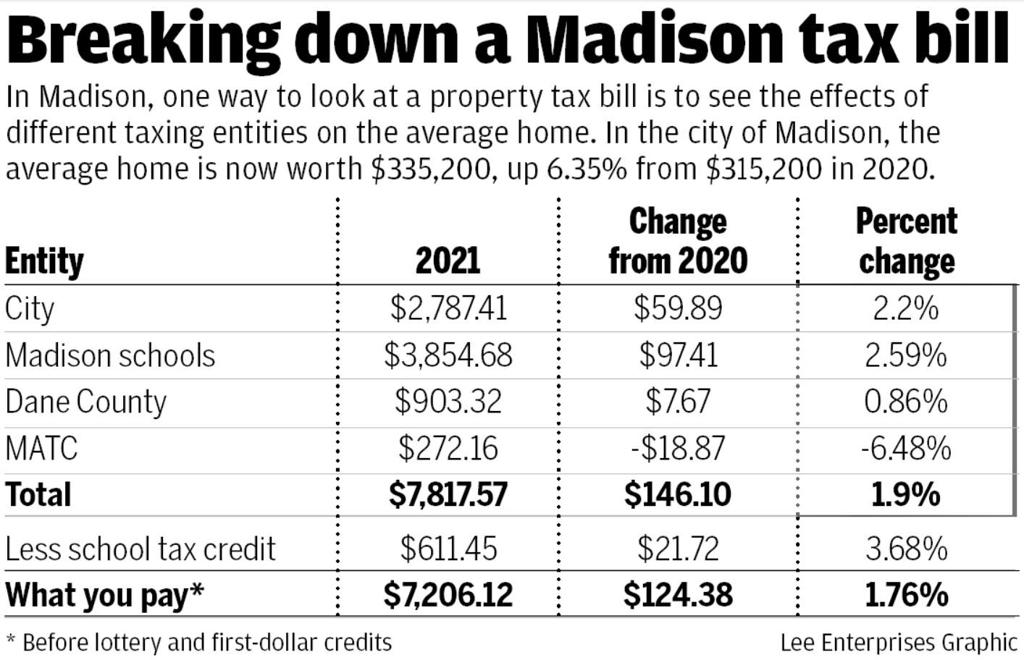

Modest Increases Coming And Even Some Decreases For Dane County Property Taxpayers Local Government Madison Com